Avant loan is type of loan that comes in two forms known as unsecured, which doesn’t require collateral, and secured, which does. You also need to have a good credit score and history. Not forgetting that it takes Avant up to 2-4 days to verify and get your loan approved. Avant loan does not have any penalties for early payment. Its platform is to give its consumers the flexibility to get money when they need it and return it when they don’t.

Additionally, Avant LLC, formerly known as AvantCredit, is a private company based in Chicago, Illinois, in the financial technology industry. Avant was established in 2012 by serial entrepreneurs Albert “AI” Goldstein, John Sun, and Paul Zhang. The chief executive officer is Matt Bochenek, and it is headquartered in Chicago, Illinois, United States. This comes with a revenue of 316.7 million USD in the year 2017. Avant is a legitimate online lender that offers loans to applicants, providing both secured and unsecured options.

Is Avant a direct lender?

Avant is a well-known online lender, and it does not require in-person visits or even calls to finish the loan application. You are at an advantage if you have a credit score of 620, as you can go for OneMain Financial.

Is Avant a legit company?

Avant is a legit online lender that is well known in the United States, as it’s registered to render services in that country. Also, it is a legal requirement to become a legitimate lender. Its loans are unsecured loans that are given to you based on your credibility. And your credit score also determines the amount you are qualified for. Avant has been in existence since 2012, and has its secure website. This means your data stays safe, and the company is also recognized by the bureau.

Does an Avant loan need collateral?

There are two types of loans that Avant offers. Avant provides unsecured and secured online personal loans with a speedy funding period for accepted applications. Avant secured loans require collateral, but unsecured loans do not.

Does Avant give credit increases?

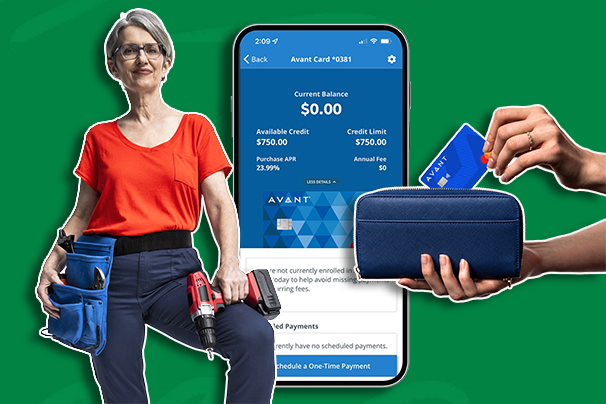

Avant credit card users can ask for a credit limit increase, but the chances of approval are very slim, but if there is a good history of on-time payments and low credit usage. Individuals can also ask for an Avant credit limit increase by reaching out to customer service.

Can I pay off an Avant loan early?

The famous online lender does not have any penalties for early payments. Although some lenders request penalties for late or overdue payments, the Avant online lender is an exception. One of the purposes of Avant is to allow its customers to borrow money when they need it and pay the money back after they have sorted out their issues.

How long does it take for Avant to approve the loan?

It takes about 2 to 4 days to receive money from the Avant personal loan; in some cases, the Avant loan timeline adds 1 to 2 business days to get approval for your Avant loan and another 1 to 2 business days to get the funds after it has been approved.

Does Avant ask for proof of income?

Every loan applicant must provide their income source information, and if there is a need for further verification, then a task will be shown on your dashboard, or one of the Avant agents will check on you directly.