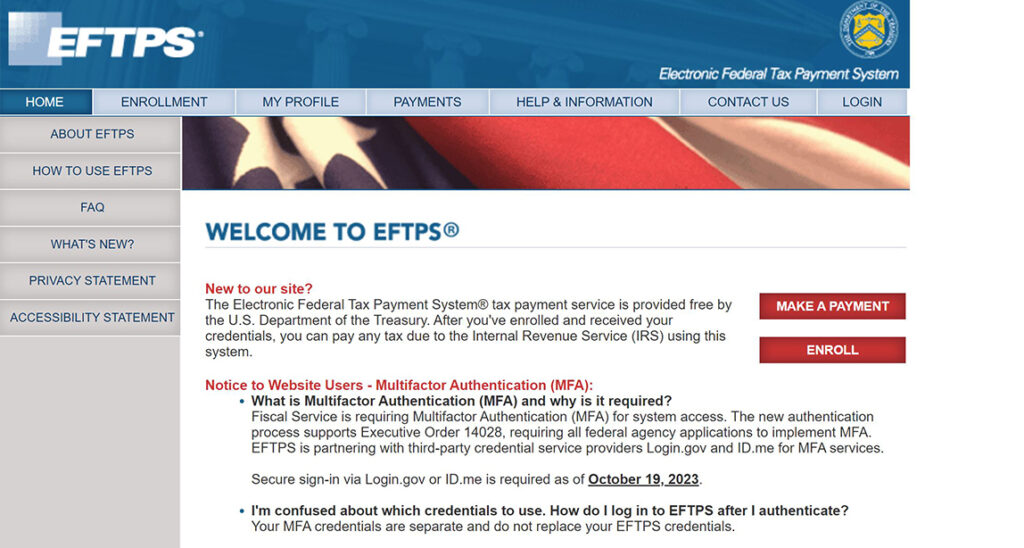

Have you been searching for the most convenient way to make all your business tax payments online and without hassle? Then, you need to visit the EFTPS Platform to quickly make all your Business tax payments with ease. What is EFTPS therefore and why should I use it? EFTPS which stands for Electronic Federal Tax Payment System is a free and secure tool provided by the United States of America Department of Treasury.

It was created in the year 1996 to enable individuals and businesses to make online payments for their federal taxes. EFTPS is maintained by the IRS (Internal Revenue Service) and Bureau of the Fiscal Service branches of the U.S. Department of Treasury. Since the inception of the Electronic Federal Tax Payment System (EFTPS), it has been able to process more than a billion payments.

Through its website and phone systems as well as through special channels for payroll providers, Financial institutions, tax professionals, and other authorized third parties. The system is free and reliable to make use of. In addition, EFTPS is convenient to use and this is because you are free to make scheduled payments whenever you want. 24 Hours, a Day, 7 Days a Week, you can schedule your payment plan. You also have the chance to enter your payment instructions for businesses and individuals up to 364 days in advance.

Payments That Can be Made with EFTPS

There are quite several payments that can be made through EFTPS. Some of these payments include;

- Estimated Taxes

- Corporate Taxes

- Self Employment Taxes

- Excise taxes On alcohol, Gasoline, and certain other goods

- Payroll taxes including Federal Insurance Contribution Act Taxes

Why Should I Use Electronic Federal Tax Payment System (EFTPS)?

Using EFTPS is not mandatory but there are several reasons why you should consider using the service. Below are some of the reasons why you should consider using Electronic Federal Tax Payment System;

- It is fast to use because you can easily make payments in minutes

- You get to review your information before clicking on send which makes it accurate

- EFTPS is convenient to use; you can make payment from any internet or phone connection

- The service is easy to use

Also, EFTPS is secure to use as you can make online payments with ease. You will need your Employer Identification Number (EIN) or Social Security Number (SSN), a Personal Identification Number (PIN), and an Internet Password. Note that; phone payments require your PIN and your EIN/SSN.

EFTPS Enrollment

As a new user of EFTPS, you will need to enroll so you can start taking advantage of its service. Enrolling in the service can be done via the official website. Better still, you can request an enrollment form by contacting its customer care service. You can call 800-555-4477, 877-333-8292, 800-733-4829 OR 800-244-4829. If you wish to apply online, you can follow the below steps and guidelines;

- Visit the official website of EFTPS

- On the homepage, click on ENROLL

- This takes you to another page

- Carefully read through its terms and conditions and tap on Accept

- Select how you wish to be enrolled e.g. Business or Individual or Federal Agency

- You will be provided with a form to fill

- Enter the correct details based on what you have selected

Finally, Review the form and proceed to complete the enrollment by following the on-screen instructions. Once you have successfully enrolled for EFTPS, you can start making payments.

How to Make Payments with EFTPS

If you have already enrolled in the Electronic Federal Tax Payment System, you can log in to your account and make a payment. Below are the steps and guidelines to follow;

- Visit the official website of EFTPS

- Click on Make Payment

- You will be required to login to your account

- Login to your EFTPS Account

Lastly, follow the step-by-step instructions to successfully make your EFTPS Online Payments. Once you have completed the transaction, you will receive a confirmation number as a receipt. You will also receive an email alert to keep you aware of your payment status. And it will have up to 15 months of payment history. Changes and cancellations can be made up to two days prior. Finally, you can schedule payments up to 365 days ahead of time by selecting a specific date for the fund transfer.